Family companies are synonymous with stability and longevity, where the appointment of top management is decided on dynastic grounds. But today they have disappointing statistics: less than a third of such companies survive until the transfer of power to their “grandchildren”. And those who remain “alive” have to think about how to develop a strategy that will make money now and maintain continuity in 50 years. The Deloitte Family Business Services Center interviewed just under 800 executives from 58 countries around the world. The experts identified the strengths and weaknesses of business dynasties, learned why a family council is just as important as a meeting of directors, and what the advantage of two-horizon planning is.

Family businesses, where the name is also the last name of the founder, are traditionally considered by experts to be sustainable. Such companies prefer long-term planning and check their business course with internal values, and in times of crisis they show resilience. However, even these companies, according to Deloitte experts, cannot find a balance in matters of principle.

“There is an impression that many families managing their own businesses are postponing certain strategic issues, focusing on urgent matters, while the balance between long-term goals and short-term needs is at the heart of success,” said Carl Allegretti, head of Deloitte Private.

Thus, 68% of CEOs responded in the affirmative to the question “Do you intend to keep the business in the family?” Such expectations, according to experts, are related to non-economic goals: families rarely sell or close a business, and are often willing to survive times of financial hardship. But not everyone is so reverent about the family business: a third of respondents (34%) admitted that they would be willing to give up a share of control of the business if it would provide them with long-term financial success.

Moreover, as the Deloitte study found, the managers and employees of non-family companies do not always associate enterprise stability and generational continuity – only 41% of respondents. Whereas ownership structure, management and strategy, according to more than half of the survey participants, meet the long-term goals. Experts are concerned about this: effective planning of business transfer from generation to generation is the connecting link between the present and the future.

What do family companies have on their balance sheet other than money?

Deloitte Private notes that business dynasties have strengths that ensure their stability today: flexibility, interest in innovation, readiness (despite stereotypes) to differentiate the portfolio and relatively little anxiety about instability in the world. In support of the thesis, the researchers cite the following statistics:

- 61% of respondents said that flexibility is the most important characteristic of family business;

- 39% of employees of family businesses believe that their businesses are interested in innovation;

- 26% of entrepreneurs are not afraid to break the stereotype and lose control over assets if it will bring them sustainability for the next 10-20 years;

- only 13% of employees of family businesses are concerned about the impact of geopolitical instability on their business.

Family council, guest stars, and a plan that everyone agrees on

Employees and executives of companies with annual revenues of less than $50 million (43%) and up to $1 billion or more (21%) agreed to participate in the Deloitte Private survey. Based on their responses, the experts developed recommendations for family-owned businesses.

If you trust them, it’s family-owned companies like these. Despite the fact that internal cash flows allow to maintain some dependence on external capital, economic development and widespread innovation dictate to invest more and more in the business. One way out is the sale of minority (non-controlling) stakes. But outside shareholders can interfere in the family strategy and dictate contradictory decisions. Experts recommend minimizing this risk by selling the same minority interest to similar family businesses or investment companies which, as a rule, have similar views on business.

Efficient management is rooted in the family. The chain of decisions can come not only from the board of directors, but also start within the close family circle. This approach will maintain harmony in the family and make the transition of power to the younger generation smooth. Research has shown that a quarter of family-owned companies discuss business strategies in family forums and boards, and in businesses, a family charter or constitution is valid.

Bringing in an outside director is a good experience. About a third of respondents noted that in their companies, most board members are independent outside managers, and a quarter of businesses have mostly “seats” reserved for family members. All the rest either do not have an official board of directors or it consists only of relatives. But this insularity can play a bad joke on the family business. Independent managers who are not emotionally or financially bound to the company can bring valuable experience and an objective point of view, according to Deloitte Private.

A succession plan needs to be spelled out. Most of the respondents admitted that their companies do not have formal or informal succession plans for key positions. Only 26% know who will take over as CEO in the future, and 34% are not aware of who will lead them when the boss retires. The remaining 40% know that this issue is unofficially decided. There is even less certainty about the positions of financial director and production manager – about 18-19% of respondents know the name of successors. In the meantime, experts say that a well-thought-out succession plan and procedure is an important point. So is working with young family members: promoting the firm’s vision and values, developing their skills, and delegating managerial responsibilities and functions to them.

Strategic planning is the key to profit and growth. The survey found that one-fifth of survey participants had no plan at all. Among those who have thought out a strategy, in 71% of cases it is intended for the next 2-5 years, and in 6% of cases – only for one year. Specialists are concerned: this is a way to scatter resources, and the trend does not correlate with the traditional guidelines for family companies – long-term prospects, continuity of management, and so on. That said, it is not enough for such businesses to take market trends into account to be successful: the plan will not be effective if it does not reflect the beliefs, values and views of each family member. Years of Deloitte surveys confirm this: CEOs say, time after time, that the greatest threat to companies comes from within rather than from outside. Indeed, among 2019 respondents, only 35% acknowledged that the company’s long-term growth plan converges with the individual and shared goals of all family members, while 60% partially agreed or disagreed altogether.

Three Horizons Instead of Two

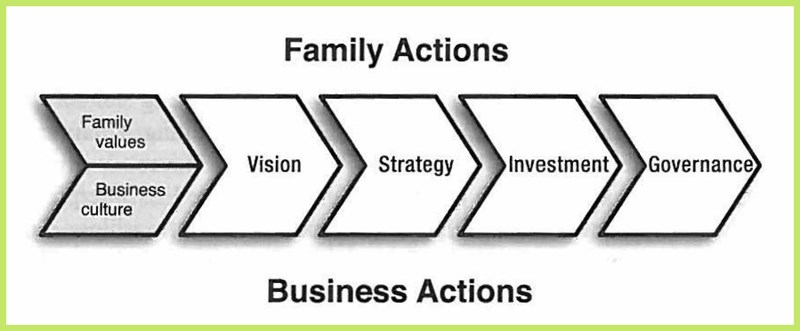

Despite the commitment to long-term planning, almost two-thirds (62%) of Deloitte’s survey participants say that profit is #1 on their list of priorities for the coming year. Next on the list are expansion, creating new products and services, human resources and updating the business model. When it comes to what’s important to them over the next 10-20 years, executives and employees of the family business sharply change direction in favor of family values: 49% of survey participants are for the protection of heritage, 36% are more concerned about family capital, and the same number believes it is important to introduce the new generation of the dynasty to the business.

Deloitte experts believe that family businesses can harmoniously combine such different long-term and short-term priorities with the help of the two-horizon planning method. Its essence is in the following: it is necessary to make a competent analysis of the market, competitors and consumers for 10-20 years in advance, and based on the data to implement short-term initiatives with the horizon of 6-12 months. In this case, the company consciously abandons the common five-year horizon and does not spend extra time and resources. Experts are confident that the family business will be able to take such an approach, especially as the survey showed that more than half of the companies are constantly working on forecasts of market dynamics for the next couple of decades.